Facts About Independent Financial Advisor copyright Revealed

Facts About Independent Financial Advisor copyright Revealed

Blog Article

All about Ia Wealth Management

Table of ContentsExamine This Report on Independent Financial Advisor copyrightThe Definitive Guide to Lighthouse Wealth ManagementThe 6-Second Trick For Retirement Planning copyrightLittle Known Facts About Tax Planning copyright.Little Known Facts About Retirement Planning copyright.The 2-Minute Rule for Financial Advisor Victoria BcThe Ultimate Guide To Financial Advisor Victoria BcTop Guidelines Of Financial Advisor Victoria Bc4 Easy Facts About Ia Wealth Management Described

They make money by charging you a charge for each trade, a set monthly fee or a portion paid about buck amount of assets being managed. Traders wanting suitable expert should ask a many concerns, including: A financial advisor that actually works to you will likely not end up being the same as a financial consultant who works with another.Based on whether you’re shopping for a wide-ranging monetary strategy or are merely in search of investment guidance, this question can be crucial. Investment analysts have actually different ways of billing their customers, and it'll typically depend on how many times you use one. Definitely ask when the consultant employs a fee-only or commission-based system.

All About Investment Representative

Whilst you must devote some try to find the right monetary specialist, the work are beneficial if the consultant offers you strong advice helping put you in a much better financial position.

Vanguard ETF Shares aren't redeemable right because of the issuing fund apart from in huge aggregations really worth millions of dollars (https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1706079058&direction=prev&page=last#lastPostAnchor). ETFs tend to be at the mercy of marketplace volatility. When purchasing or selling an ETF, you are going to shell out or get the economy price, which may be basically than net asset value

About Private Wealth Management copyright

Usually, however, an economic expert may have a training. When it’s not through an academic plan, it's from apprenticing at an economic advisory firm (https://myanimelist.net/profile/lighthousewm). People at a firm who happen to be nonetheless studying the ropes are often labeled as associates or they’re part of the management staff. As mentioned earlier in the day, though, numerous analysts originate from different industries

Fascination About Tax Planning copyright

Meaning they have to place their customers’ best interests before their particular, among other things. Some other monetary analysts tend to be people in FINRA. This has a tendency to indicate that they've been agents which additionally give expense guidance. As opposed to a fiduciary standard, they legally must follow a suitability standard. Which means there is certainly a fair basis because of their investment recommendation.

Their particular names often say it-all:Securities licenses, alternatively, are more about the income part of trading. Investment analysts who are in addition brokers or insurance rates agencies are apt to have securities licenses. Should they directly purchase or offer shares, bonds, insurance rates items or provide financial guidance, they’ll require particular permits pertaining to those items.

Retirement Planning copyright Can Be Fun For Everyone

Always make sure to inquire of about financial experts’ fee schedules. To track down these details all on your own, look at the firm’s Form ADV it files utilizing the SEC.Generally talking, there are 2 different pay buildings: fee-only. tax planning copyright and fee-based. A fee-only advisor’s main kind compensation is by client-paid charges

When trying to realize how much cash a monetary specialist expenses, it’s crucial that you understand there are a number of payment techniques they may use. Here’s an introduction to everything might run into: economic experts may paid a portion of one's total possessions under administration (AUM) for dealing with your cash.

The Best Strategy To Use For Tax Planning copyright

59percent to 1. 18percent, typically. retirement planning copyright. Normally, 1percent is seen as a requirement for approximately so many dollars. Many analysts will reduce the percentage at greater degrees of assets, so you are investing, state, 1percent for any first $1 million, 0. 75% for the next $4 million and 0

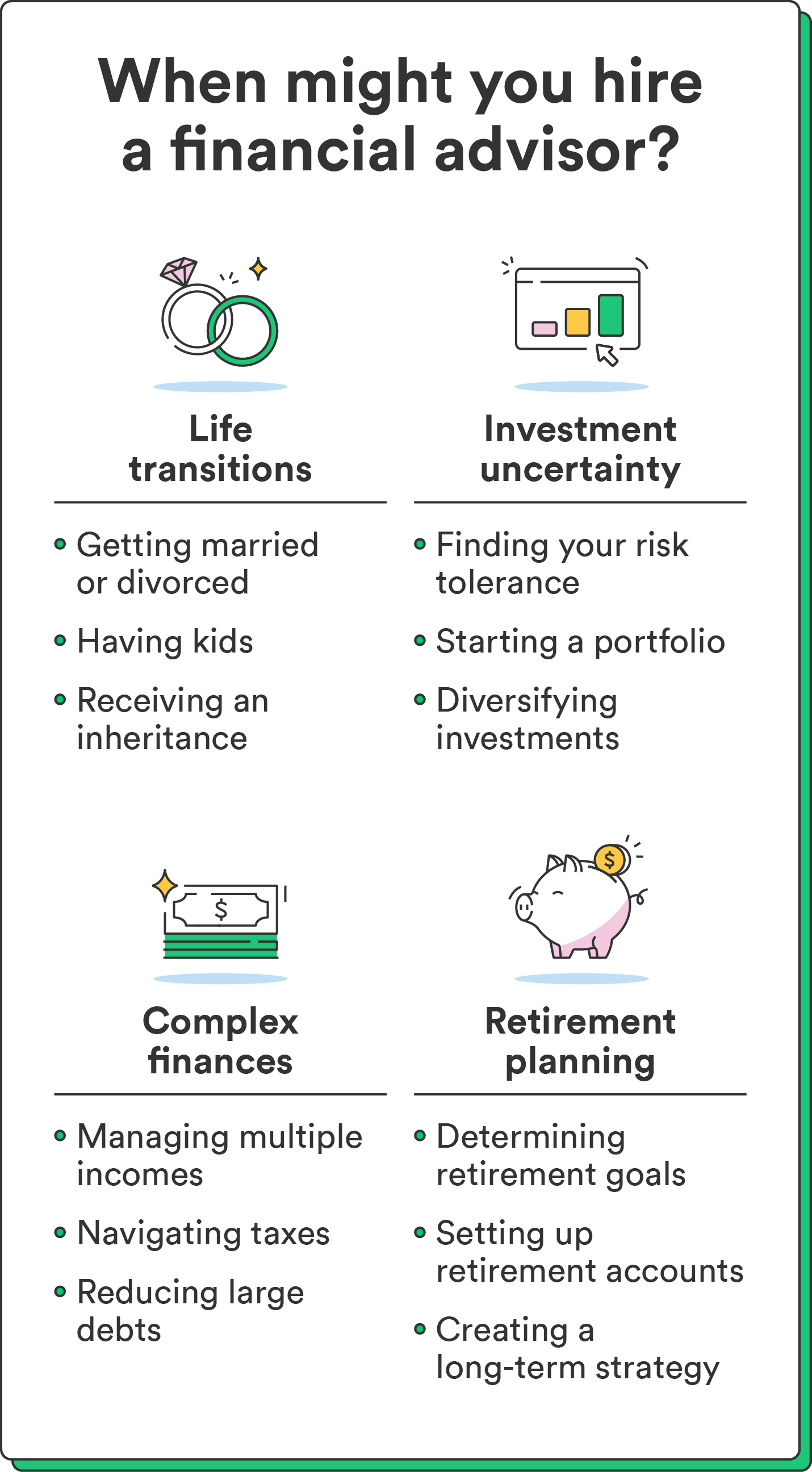

Whether you need a financial advisor or perhaps not is determined by simply how much you've got in possessions. Select your own comfort level with cash administration subject areas. If you have an inheritance or have recently investment representative come right into a sizable sum of cash, subsequently a monetary expert could help answr fully your financial questions and arrange your hard earned money.

The 20-Second Trick For Lighthouse Wealth Management

Those differences might seem clear to prospects inside investment industry, but some consumers aren’t familiar with them. They might think of monetary preparing as compatible with expense management and information. And it also’s true that the contours amongst the vocations have cultivated blurrier in the past few years. Financial investment advisors tend to be more and more dedicated to supplying alternative monetary planning, as some people look at the investment-advice piece becoming just about a commodity consequently they are pursuing broader knowledge.

If you’re seeking holistic preparation guidance: a monetary coordinator is suitable if you’re seeking wide financial-planning guidanceon your expense profile, but other parts of the plan at the same time. Look for individuals who name on their own monetary coordinators and inquire prospective planners if they’ve earned the certified economic planner or chartered economic expert designation.

The smart Trick of Tax Planning copyright That Nobody is Talking About

If you would like investment information first and foremost: if you believe debt program is in good shape as a whole nevertheless need help picking and managing your opportunities, a financial investment advisor may be the route to take. These types of people are frequently signed up investment analysts or have employment with a company which; these advisors and advisory businesses take place to a fiduciary standard.

If you wish to assign: This setup will make good sense for very active people that merely do not have the time or interest to participate from inside the planning/investment-management process. Additionally, it is one thing to give consideration to for older traders that are concerned with the possibility of cognitive decline and its particular affect their capability to manage unique funds or financial investment portfolios.

An Unbiased View of Lighthouse Wealth Management

The writer or authors never own stocks in virtually any securities pointed out in this article. Learn about Morningstar’s article guidelines.

Just how close a person is to retirement, eg, or perhaps the influence of major existence activities including marriage or having youngsters. Yet this stuff aren’t beneath the command over an economic planner. “Many happen arbitrarily as well as aren’t anything we can impact,” claims , RBC Fellow of Finance at Smith School of Business.

Report this page